Author: theroylegroup@century21.ca

Military Relocation / Feb 26, 2024

Guide to Military Relocation: CFB Trenton & CFB Kingston

Are you preparing for a military relocation to or from CFB Trenton or CFB Kingston?

Moving can be a stressful and overwhelming experience, but with the right guidance, it can also be a smooth transition. At The Royle Group, we understand the unique challenges that military families face when it comes to moving. So, whether you’re new to the military lifestyle or a seasoned pro, our veteran-run team is here to guide you.

Military Relocation Process

The military relocation process is broken down into 3 key categories:

A—Before you receive your posting message

This includes information on updating your budget, spousal and partner employment, the real estate market, children’s education services, links to Military Family Resource Centres, and accessing medical care for your family.

B—You have received your posting message

This includes information on geographical boundaries, moving benefits and services, tools on buying or selling your principal residence, and the Canadian Forces Housing Agency.

When you receive your official Posting Message, you can register with BGRS. Once registered with BGRS you will be able to select all necessary service providers (either from the list of registered providers or another third party service provider). This is also the time you should consult a mortgage specialist to begin the preapproval process. This will set you up in the best way for your move and HHT. (Source: https://www.relocatingmilitary.ca/what-is-bgrs)

C—After you have completed your move

This includes information on emergency contacts and important documents, your relocation claims and related tax implications, your unsold former residence, and getting to know your new community.

Finding Housing near CFB Trenton and CFB Kingston

Whether you prefer on-base housing or off-base options, there are several resources and strategies you can utilize to find the perfect home for you and your family.

If you are considering on-base housing, start by contacting the military housing office at CFB Trenton or CFB Kingston. They will provide you with information about the available housing options, eligibility requirements, and the application process. On-base housing offers the convenience of living within the military community and often provides amenities such as playgrounds, schools, and access to support services.

If you prefer off-base housing, begin your search by contacting us – The Royle Group Team. We will be able to advise you on the current market situation and provide listings that meet all your criteria. Consider factors such as the size of the home, number of bedrooms and bathrooms, proximity to schools and amenities, and your budget.

It’s also helpful to connect with other military families in the area for recommendations and insights. (See our list of resources for Military Families below)

Once you have identified potential housing options, schedule visits to view the properties in person if possible. This will allow you to assess the condition of the home, ask any questions you may have, and get a feel for the neighbourhood.

Schools and Education Options for Military Families

The Trenton and Kingston areas offer a wide range of educational options for military families, including both public and private school boards.

- Hastings and Prince Edward District School Board

- Algonquin & Lakeshore Catholic District School Board

- Limestone District School Board

- Kawartha Pine Ridge School Board

- Peterborough Victoria Northumberland and Clarington Catholic District School Board

- Conseil des écoles catholiques du Centre-Est de l’Ontario

- Ecole L’Envol

- Belleville District Christian School

- Trenton Christian School

- Quinte Christian High

- Albert College

- Belleville Montessori School

- Sagonaska Demonstration School

- Sir James Whitney School

- Upper Canada District Board

Healthcare Services for Military Families

The Trenton and Kingston areas offer a range of healthcare services, including both military and civilian options.

- Ontario Health Insurance Plan (OHIP): Military families can apply for OHIP as soon as they have a permanent address in Ontario, which pays for many of the health services you may need to access during your time here.

- Finding a Family Doctor: To maximize your chances of finding a family doctor, it is recommended that you apply to Health Care Connect and The Calian CARES™: Military Family Doctor Network (MFDN) waiting lists. You are also encouraged to call local doctors offices to see if they have any available spaces for military families.

(Source: https://trentonmfrc.ca/health-care/)

Transportation and Commuting Options

The Trenton and Kingston areas offer a variety of transportation options to meet the needs of military families.

- If you prefer to commute by car, familiarize yourself with the local road networks and traffic patterns. Consider factors such as proximity to CFB Trenton or CFB Kingston, the availability of parking, and the overall convenience of the commute. It’s also important to research the local driving laws and regulations to ensure compliance.

- Public transportation is another option to consider. Both Trenton and Kingston have public bus services that provide transportation within the cities and surrounding areas. Research the bus routes, schedules, and fares to determine if public transportation is a viable option for your daily commute.

- Lastly, don’t forget to explore carpooling and ridesharing options. Connecting with other military families in your area can help reduce commuting costs and provide companionship during the journey.

Benefits of Working with a Veteran Run Real Estate Team

When it comes to finding the perfect home during a military relocation, working with a veteran-run real estate team can offer unique advantages and expertise. Our team of professionals understand the needs and challenges of military families and can provide valuable insights and guidance throughout the process.

A veteran-run real estate team has firsthand experience with military relocations and understands the specific requirements and timelines involved. We can navigate the complexities of the military housing system, provide information about housing options near CFB Trenton and CFB Kingston, and negotiate on your behalf to ensure that you get the best possible deal.

Additionally, a veteran-run team has a deep understanding of the military lifestyle and can provide insights into the local community and amenities that cater to military families. We can recommend neighbourhoods, schools, healthcare facilities, and other resources based on our own experiences and the experiences of our clients.

Working with a veteran-run real estate team also provides a sense of camaraderie and trust. We have walked in your shoes and we completely understand how complex a military posting can be. Our team has assisted countless active service members and their families through the military posting process and are more than confident that we’ll be able to help you find a home that perfectly suits your needs.

Additional Support and Resources for Military Families

The Trenton Military Family Resource Centre

The Kingston Military Family Resource Centre

The Trenton Military Family Resource Centre Facebook Page

The Kingston Military Family Resource Centre Facebook Page

CFB Trenton Military Spouses Facebook Page

CFB Kingston Military Spouses Facebook Page

Read the Full Canadian Armed Forces Relocation Directive (CAFRD) HERE

Conclusion

By following the tips in this guide, you’ll be well-equipped to navigate the complexities of a military move and settle into your new community with ease.

At The Royle Group, we’re here to support you every step of the way. We understand the unique needs of military families and are committed to providing you with the best guidance and resources for your relocation journey!

Posted Out Of CFB Trenton or CFB Kingston? Get in touch with our team HERE

Posted To CFB Trenton or CFB Kingston? Get in touch with our team HERE

Want more like? “Guide to Military Relocation: CFB Trenton & CFB Kingston”

Learn More:

- Military Real Estate Podcast Episodes & More

- Military to Real Estate: Is a Career in Real Estate Your Next Mission?

- Learn More About Military Postings

- Meet Our Veteran-Run Team

Tools & Resources:

- Discover What You Can Afford: Use Our Buyers Calculator

- Browsing For Homes? Start Your Home Search

- Sell Your Current Home: Get A Free Home Valuation

- Book A Consultation With One of Our Agents

Follow us on social media for more tips and updates:

Community / Feb 8, 2024

Transit Changes in Belleville Ontario

Stay up to date on the transit changes in Belleville Ontario! Belleville’s bus routes are undergoing a transformation as the City Council approved a new master transit plan in August 2023. (Quinte News) The primary goal of this plan is to optimize end-to-end travel times, reducing them significantly from the current 45-60 minutes to just 30 minutes.

But what’s the connection to the real estate market? Shorter commute times spanning various neighbourhoods go beyond mere convenience. The ability for individuals to select from a diverse range of neighbourhoods without compromising accessibility has a direct impact on our real estate landscape.

Properties situated in areas with well-established transit options tend to be perceived as more attractive, potentially leading to higher property values.

Given that housing and transportation are among the most substantial financial burdens for the average household, investing in enhanced accessibility becomes crucial.

Stay informed about the evolving landscape! If you’re curious about how these changes might affect you, check out the updated transit map HERE.

Resources:

Want more like? “Transit Changes in Belleville Ontario”

Learn More:

- About The Belleville Area

- Relocating to The Belleville or Trenton Area

- Live Near A Golf Course in Belleville Ontario

Tools & Resources:

- Prepare To Buy: Download Our FREE Buyers Workbook

- Curious What You Can Afford?: Use Our Buyers Calculator

- Browsing For Homes? Start Your Home Search

- Hoping to Sell? Get A Free Home Valuation

- Book A Consultation With One of Our Agents

Buying / Jan 15, 2024

How Mortgage Pre-Approval Works

Are you tired of not knowing if you can afford your dream home? Mortgage pre-approval may be the secret weapon to starting your journey. In this article, we’ll explain how mortgage pre-approval works and how it can give you a significant advantage when shopping for a home.

By getting pre-approved for a mortgage, you’ll have a clear understanding of how much you can afford, allowing you to narrow down your search to properties within your budget. Not only does this save you time and energy, but it also positions you as a serious buyer in the eyes of sellers. With a pre-approval letter in hand, you can make strong and confident offers, increasing your chances of being selected over other hopeful homebuyers.

Additionally, mortgage pre-approval helps speed up the closing process. Since you’ve already provided the necessary financial documentation to the lender, they can move quickly to finalize your loan once you find the perfect home. As a result, you can potentially close on a property faster, giving you an edge in a fast-paced market.

Don’t let your dream home slip through your fingers. Discover the power of mortgage pre-approval and gain the upper hand in the housing market today.

Benefits of Mortgage Pre-Approval

There are several benefits to obtaining a mortgage pre-approval. First and foremost, it gives you a clear understanding of your budget. By knowing how much you can afford, you can focus your search on properties within your price range. This saves you time and energy, as you won’t waste it on homes that are out of your financial reach.

Additionally, mortgage pre-approval gives you an advantage when negotiating with sellers. With a pre-approval letter in hand, you can confidently make offers, knowing that you have the financial backing to follow through. This can make a significant difference in a competitive market, where sellers often favour buyers who are more likely to secure financing.

Furthermore, mortgage pre-approval helps streamline the closing process. Since you’ve already provided the necessary financial documentation to the lender, they can move quickly to finalize your loan once you find the perfect home. This can potentially save you weeks or even months in the closing process, allowing you to secure the property before other interested buyers.

Mortgage Pre-Qualification VS Pre-Approval

Many people use the terms pre-qualification and pre-approval interchangeably, but they are not the same thing. While both can give you an idea of how much you might be able to borrow, pre-qualification is a preliminary assessment based on self-reported information. It doesn’t require any supporting documentation and is often done online or over the phone.

On the other hand, mortgage pre-approval is a more detailed process that involves providing the lender with documentation to verify your financial information. This includes income statements, bank statements, and credit history. The lender will review these documents and assess your creditworthiness before issuing a pre-approval letter.

It’s important to note that pre-qualification is not as reliable as pre-approval. Since it’s based on self-reported information, the lender hasn’t had a chance to verify your financial situation. Therefore, pre-qualification should be seen as a rough estimate, while pre-approval gives you a more accurate picture of your borrowing power.

The Mortgage Pre-Approval Process

The mortgage pre-approval process typically starts with an application. You will need to provide information about your income, assets, debts, and employment history. The lender will also request permission to pull your credit report, which they will use to assess your creditworthiness.

Once you’ve submitted your application, the lender will review your information and determine whether you meet their criteria for pre-approval. This includes evaluating your credit score, debt-to-income ratio, and other factors that indicate your ability to repay the loan. If you meet their requirements, they will issue a pre-approval letter stating the maximum loan amount you qualify for.

It’s important to note that mortgage pre-approval is not a guarantee of financing. While it gives you a strong indication of how much you can borrow, the final loan approval will depend on factors such as the property appraisal and underwriting process. However, pre-approval does put you in a favourable position when making offers and can significantly increase your chances of securing financing.

Documents Required for Mortgage Pre-Approval

To get pre-approved for a mortgage, you will need to provide several documents to the lender. These documents help verify your financial information and determine your creditworthiness. While the specific requirements may vary between lenders, here are some common documents you may need to provide:

1. Proof of income: This includes recent pay stubs, W-2 forms, and tax returns. If you’re self-employed, you may need to provide additional documentation such as profit and loss statements.

2. Bank statements: Lenders will typically request several months’ worth of bank statements to verify your savings and assess your spending habits.

3. Employment verification: This can be in the form of a letter from your employer or recent pay stubs that show your income and length of employment.

4. Identification: You will need to provide a valid form of identification, such as a driver’s license or passport.

5. Credit report: The lender will pull your credit report to assess your creditworthiness. It’s a good idea to review your credit report beforehand to ensure its accuracy.

6. Other financial documentation: Depending on your situation, the lender may request additional documents, such as proof of assets or divorce decrees.

It’s important to gather these documents before starting the pre-approval process to ensure a smooth and efficient application process.

Finding a Lender for Mortgage Pre-Approval

To get pre-approved for a mortgage, you will need to find a lender who offers this service. Here are some steps to help you find the right lender:

1. Research local lenders: Start by researching different lenders in your area. Look for lenders who have a good reputation and specialize in mortgage pre-approval.

2. Read reviews: Check online reviews and testimonials from previous clients to get an idea of the lender’s reputation and customer service.

3. Ask for recommendations: Reach out to friends, family, and real estate professionals for recommendations. They may have worked with lenders in the past and can provide valuable insights.

4. Compare rates and terms: Once you have a list of potential lenders, compare their rates, terms, and fees. This will help you find the lender who offers the best terms for your situation.

5. Schedule consultations: Contact the lenders on your list and schedule consultations to discuss your pre-approval needs. This will give you an opportunity to ask questions, learn more about their process, and determine if they are a good fit for you.

Remember, finding the right lender is an important step in the pre-approval process. Take the time to research and compare lenders to ensure you find one that meets your needs and offers competitive terms.

Common Misconceptions About Mortgage Pre-Approval

Mortgage pre-approval can be a powerful tool in the home buying process, but there are some common misconceptions that need to be addressed:

1. Pre-approval guarantees a loan: While mortgage pre-approval gives you a strong indication of how much you can borrow, it is not a guarantee of financing. Final loan approval will depend on factors such as the property appraisal and underwriting process.

2. Pre-approval is only valid for a limited time: Pre-approval letters typically have an expiration date, usually around 90 days. However, this doesn’t mean you can’t get pre-approved again if your initial pre-approval expires. Keep in mind that your financial situation may change, so it’s a good idea to get pre-approved closer to when you’re ready to make an offer.

3. Pre-approval affects your credit score: While the lender will pull your credit report during the pre-approval process, it typically has a minimal impact on your credit score. Multiple credit inquiries within a short period of time for the same purpose, such as mortgage pre-approval, are usually treated as a single inquiry.

4. Pre-approval is a commitment to a specific lender: Getting pre-approved for a mortgage does not obligate you to work with a specific lender. You are free to shop around and compare rates and terms before choosing a lender for your final loan. However, each lender has their own policies and procedures so your overall approval may change.

It’s important to have a clear understanding of these misconceptions to make informed decisions during the pre-approval process.

Steps to Take After Receiving Mortgage Pre-Approval

Once you receive your mortgage pre-approval, there are several steps you can take to ensure a smooth home buying process:

1. Start your home search: Armed with your pre-approval letter, you can now start looking for your dream home. Focus your search on properties within your budget and work with a real estate agent who can help you find the right property.

2. Make strong offers: With your pre-approval letter in hand, you can confidently make strong offers on properties you’re interested in. Your pre-approval demonstrates to sellers that you are a serious buyer who has already taken the necessary steps to secure financing.

3. Submit required documents promptly: As you progress through the home buying process, your lender may request additional documentation. It’s important to submit these documents promptly to avoid delays in the loan approval process.

4. Stay in touch with your lender: Maintain regular communication with your lender throughout the process. They can provide updates on the status of your loan and answer any questions you may have.

5. Conduct a home inspection: Once you have an accepted offer, schedule a home inspection to ensure the property is in good condition. The inspection will identify any potential issues that may affect your decision to proceed with the purchase.

6. Finalize your loan: Once your offer is accepted and the home inspection is complete, work with your lender to finalize your loan. They will guide you through the underwriting process and ensure all necessary paperwork is completed.

By following these steps, you can navigate the home buying process with confidence and ease.

Want more like? “How Mortgage Pre-Approval Works”

Learn More:

- How to Prepare to Buy a Home

- Home Financing Podcast Episodes & More

- Buying A Home Podcast Episodes & More

Tools & Resources:

- Prepare To Buy: Download Our FREE Buyers Workbook

- Curious What You Can Afford?: Use Our Buyers Calculator

- Browsing For Homes? Start Your Home Search

- Hoping to Sell? Get A Free Home Valuation

- Book A Consultation With One of Our Agents

Or follow us on social media for more tips and updates:

Buying / Jan 15, 2024

How to Prepare to Buy a Home

Are you dreaming of owning your own home but feeling overwhelmed by the financial aspects of it? Fear not! In this article, we will guide you through the basics of how to prepare to buy a home. Whether you are a first-time buyer or looking to upgrade, having your finances in order is essential.

Get ready to achieve your homeownership dreams – let’s dive into the world of financial planning for a successful home purchase!

Assessing Your Current Financial Situation

Purchasing a home is one of the biggest financial decisions you’ll ever make. It’s essential to have a well-thought-out financial plan in place before taking the leap. Financial planning allows you to assess your current situation, set goals, and create a roadmap to achieve them. Without proper planning, you may find yourself in a financial bind or unable to secure a mortgage loan.

Before diving into the world of homeownership, it’s crucial to assess your current financial situation. This involves taking a close look at your income, expenses, and existing debts. By doing so, you can determine how much you can afford to spend on a home and what monthly mortgage payments you can comfortably handle.

Start by calculating your total monthly income. Include all sources of income, such as your salary, investments, and any additional side income. Next, list all your monthly expenses, including fixed costs like rent, utilities, and transportation, as well as variable expenses like groceries, entertainment, and dining out.

Once you have a clear understanding of your income and expenses, subtract your expenses from your income to determine your disposable income. This amount will give you a good idea of how much you can set aside for savings and potential mortgage payments.

Creating a Budget for Saving and Expenses

Creating a budget is an essential part of preparing for a home purchase.

Start by listing all your monthly income sources and subtracting your fixed expenses, such as rent or mortgage payments, utilities, and transportation costs. Next, allocate a portion of your income towards savings specifically for your home purchase. This could be a set amount or a percentage of your income. Having a dedicated savings account will help you stay disciplined and separate your home funds from your day-to-day expenses.

Determine how much you need to save for a down payment. Most lenders require a down payment of at least 20% of the home’s purchase price. Setting this goal will help you stay focused and motivated to save.

In addition to the down payment, consider other costs associated with buying a home, such as closing costs, home inspections, and moving expenses. It’s crucial to factor in these expenses when setting your financial goals to ensure you have enough funds to cover them.

Mortgage Pre-Approval

One of the first steps in the home buying process is getting pre-approved for a mortgage. This involves a lender evaluating your financial situation to determine how much they would be willing to lend you. The pre-approval process gives you an idea of your borrowing capacity, which can guide your home search and help you budget appropriately.

To get pre-approved, you’ll need to provide your lender with various financial documents, such as pay stubs, tax returns, and information about your debts. The lender will also check your credit score. A pre-approval letter from your lender states that you have the credit and financial security to afford the home you’re interested in.

Understanding Mortgage Options and Affordability

Understanding mortgage options and affordability is crucial when preparing to buy a home. Research different types of mortgages available and compare interest rates and terms. This will help you determine which option is best suited to your financial situation.

Consider visiting multiple lenders to get pre-approved for a mortgage. This process will give you a clear understanding of how much you can afford to borrow and the interest rates you qualify for. Pre-approval also strengthens your position as a buyer, as sellers see you as a serious and capable candidate.

Credit Score

Your credit score plays a crucial role in the home buying process. Lenders use it to determine your creditworthiness and to set the interest rate on your mortgage loan. Start by paying off any high-interest debts, such as credit card balances or personal loans. Focus on reducing your debt-to-income ratio, as this is an important factor lenders consider. Additionally, make sure to pay all your bills on time and avoid taking on new credit. These actions will demonstrate financial responsibility and positively impact your credit score.

Down Payment

Saving for a down payment is often the most challenging part of preparing for a home purchase. Begin by setting a target amount based on your financial goals and the price range of homes you are considering.

The down payment is a percentage of the home’s purchase price that you pay upfront. The size of the down payment can affect your mortgage terms and your monthly mortgage payments. It’s important to remember that the more substantial your down payment, the lower your mortgage loan and monthly payments will be. While the specific amount you’ll need can vary depending on the price of the home and the terms of your mortgage, it’s generally recommended to aim for a down payment of at least 20% of the purchase price. This can help you avoid the need for mortgage insurance, which can add to your monthly costs.

To speed up your savings, consider cutting back on non-essential expenses. This could mean dining out less frequently, reducing entertainment costs, or finding ways to save on utilities. Additionally, explore opportunities to increase your income, such as taking on a side job or freelancing. Every extra dollar saved brings you closer to your homeownership dreams.

Do you want to know what it takes to afford that dream house or investment property you’ve been saving for? Use our buyer calculator to compare mortgage rates, payment plans, interest rates, and finance options.

Working With Professionals

Navigating the world of financial planning can be overwhelming, especially when preparing for a home purchase. Consider working with professionals who specialize in real estate and mortgages. They can provide expert guidance tailored to your unique situation and help you make informed decisions.

A financial planner will review your finances, offer personalized advice, and help you develop a realistic plan to achieve your homeownership goals. They can also assist in finding the best mortgage options, negotiating with lenders, and ensuring you stay on track with your financial plan.

A real estate agent can guide you through the process, helping you find a home that fits your budget and meets your needs. They can also put you in contact with local and reputable financial planners, advisors, and other resources.

Government Programs and Incentives

As a first-time homebuyer in Ontario, you may be eligible for various government programs and incentives that can help make homeownership more affordable. These can include tax credits, grants, and loan programs designed to assist first-time buyers.

For example, the Home Buyers’ Plan (HBP) allows first-time homebuyers to withdraw up to $35,000 from their Registered Retirement Savings Plan (RRSP) to buy or build a qualifying home. The funds withdrawn must be repaid within 15 years, but this can provide a significant boost to your down payment savings.

A first home savings account (FHSA) is a registered plan allowing you, as a prospective first-time home buyer, to save for your first home tax-free (up to certain limits). You may be eligible to save up to $40,000 tax-free to buy a home with an annual contribution limit of $8,000.

It’s important to research these programs and understand the eligibility requirements and terms before you begin the home buying process.

Tips for Staying on Track With Your Financial Plan

Sticking to your financial plan is essential to achieving your homeownership dreams. Here are some tips to help you stay on track:

1. Monitor your progress regularly: Keep a close eye on your savings, expenses, and debt reduction. Regularly reviewing your financial situation will help you identify areas for improvement and ensure you are on target to meet your goals.

2. Stay disciplined: Avoid unnecessary spending and stick to your budget. It’s easy to get caught up in the excitement of buying a home, but staying disciplined will ensure you have enough funds for a down payment and other associated costs.

3. Automate savings: Set up automatic transfers from your paycheck to your dedicated home savings account. This way, you won’t have to rely on willpower alone to save, and your savings will grow consistently.

4. Seek support: Share your financial goals with friends and family. Having a support system can provide motivation and accountability throughout the home buying process.

Key Steps for Getting Started

1. Review your finances: Understand your current financial situation, including your income, expenses, and existing debt.

2. Check your credit score: Your credit score can significantly impact your ability to get a mortgage and the interest rate you’ll pay.

3. Save for a down payment: Start saving as early as possible. The larger your down payment, the less you’ll need to borrow.

4. Get pre-approved for a mortgage: This will give you an idea of how much you can afford and show sellers that you’re a serious buyer.

5. Research government programs and incentives: Take advantage of any programs for which you’re eligible. These can make homeownership more affordable.

6. Work with professionals: A real estate agent can guide you through the process, helping you find a home that fits your budget and meets your needs.

By following these steps, you can prepare your finances for a home purchase and make the process of buying your first home a little less daunting. At The Royle Group, we understand the gravity of your journey towards homeownership. Our team is here to provide personalized guidance and support at every step. If you’re ready to turn your homeownership dreams into reality, connect with us today. Your future home awaits, and we’re here to make your real estate journey seamless and successful.

Want more like? “How to Prepare to Buy a Home”

Learn More:

- Mortgage Pre-Approval: How it Can Give You an Advantage

- Home Financing Podcast Episodes & More

- Buying A Home Podcast Episodes & More

Tools & Resources:

- Prepare To Buy: Download Our FREE Buyers Workbook

- Curious What You Can Afford?: Use Our Buyers Calculator

- Browsing For Homes? Start Your Home Search

- Hoping to Sell? Get A Free Home Valuation

- Book A Consultation With One of Our Agents

Or follow us on social media for more tips and updates:

Buying / Nov 6, 2023

Buying or Selling Winter Real Estate

The holiday season is almost upon us, bringing with it a sense of joy, celebration, and the warmth of family gatherings. But for some, it also raises a critical question: Is this the right time to buy or sell a home, especially in the period leading up to the holidays? Great opportunities can arise in the Winter real estate market, but it comes with a unique set of pros and cons.

At The Royle Group, we understand that this decision requires careful consideration. To assist you in making an informed choice, we’ve outlined the advantages and disadvantages of buying or selling your home in the winter real estate market.

Pros of Buying or Selling

1. Motivated Buyers and Sellers

During the holidays, those actively involved in real estate transactions are typically highly motivated. If someone is taking time out of their busy holiday schedule to buy or sell a home, they usually have a pressing reason to do so. This can lead to more straightforward negotiations and quicker transactions.

2. Less Competition

Many buyers and sellers tend to postpone their real estate plans until the spring. This means there are fewer properties on the market and potentially fewer buyers to compete with, creating a less crowded and competitive environment. Less competition can be advantageous for both buyers and sellers.

3. Beautifully Decorated Homes

For sellers, holiday decorations can make your home look warm, inviting, and attractive to potential buyers. The cozy ambiance created by holiday decor can help buyers envision themselves living in the space.

4. End-of-Year Tax Benefits

Buyers might be motivated to close a deal before the end of the year to take advantage of tax benefits. This could mean that they’re more willing to negotiate and meet your terms.

Cons of Buying or Selling

1. Limited Inventory

The holiday season often sees a reduction in the number of properties available for sale. This can limit your options as a buyer. If you’re selling, you might not attract as many potential buyers due to the reduced inventory.

2. Weather-Related Challenges

Winter weather can create logistical challenges, such as snow and icy conditions, which can affect property showings and moving. This could lead to delays and complications in the buying or selling process.

3. Distractions and Time Constraints

The holidays can be a hectic time, with parties, shopping, and travel. Both buyers and sellers might be preoccupied, making it challenging to schedule showings, inspections, or meetings with real estate professionals.

4. Buyer’s Market vs. Seller’s Market

The holiday real estate market can vary depending on location and economic conditions. In some areas, it might be a buyer’s market with favorable conditions for buyers, while in others, it could be a seller’s market. Understanding the local market dynamics is crucial.

In Conclusion

Buying or selling a home in the period right before the holidays offers both advantages and challenges. Deciding whether it’s the right time for you depends on your specific situation, local market conditions, and personal preferences. The Royle Group is here to guide you through the process, no matter the season. We provide personalized real estate services tailored to your unique needs. If you’re contemplating a real estate transaction this holiday season, don’t hesitate to reach out to us. We’ll help you weigh the pros and cons and make a well-informed decision.

Want more like? “Buying or Selling Winter Real Estate”

Learn More:

- How to Prepare to Buy a Home

- Mortgage Pre-Approval: How it Can Give You an Advantage

- Stage Your Home for Winter

- Home Selling Resources, Podcast Episodes & More

- Buying A Home Podcast Episodes & More

Tools & Resources:

- Prepare To Buy: Download Our FREE Buyers Workbook

- Curious What You Can Afford?: Use Our Buyers Calculator

- Browsing For Homes? Start Your Home Search

- Hoping to Sell? Get A Free Home Valuation

- Book A Consultation With One of Our Agents

Selling / Dec 5, 2024

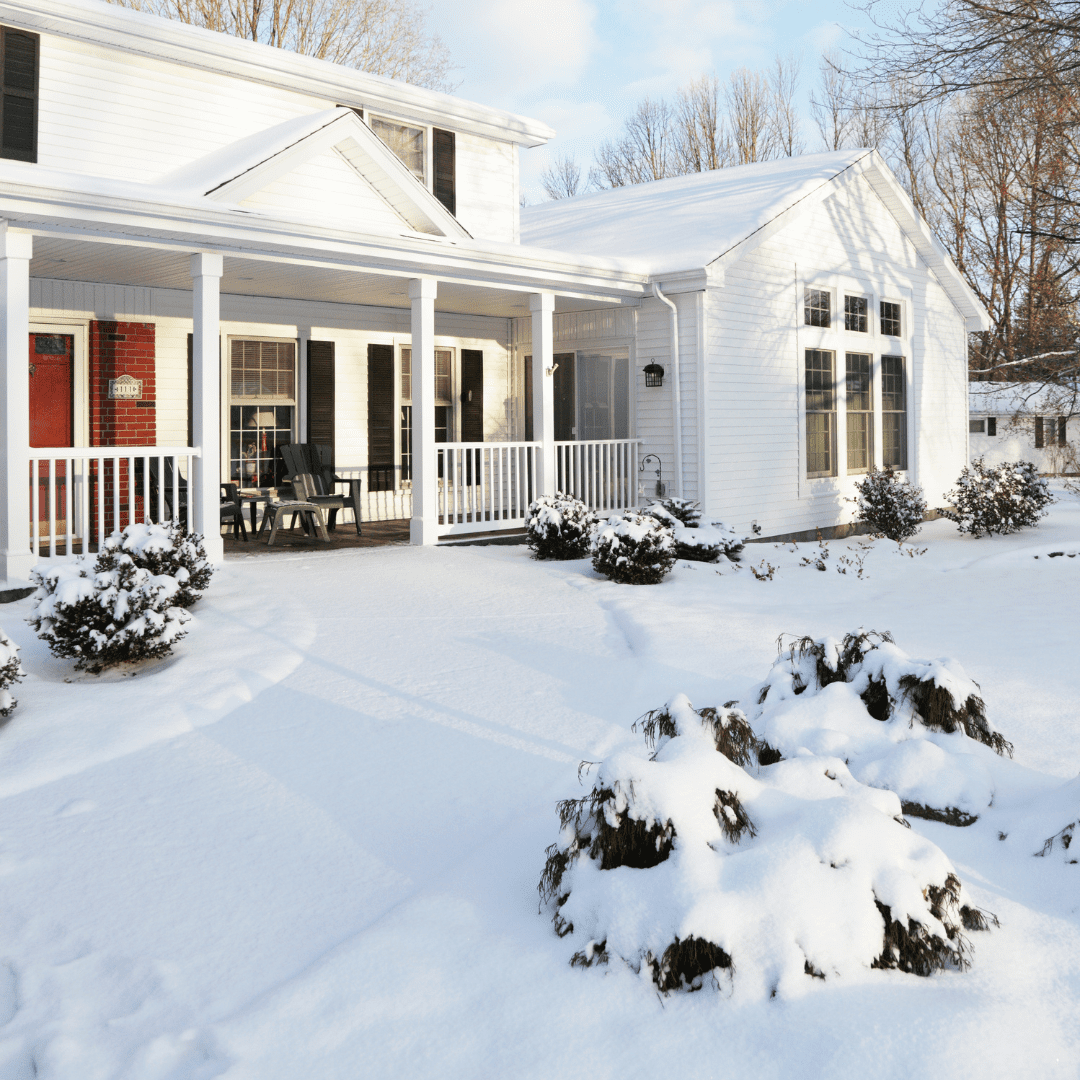

How to Stage Your Home for a Successful Winter Sale

Fall and winter bring unique challenges and opportunities for selling your home. However, with the right staging, you can make your property stand out and appeal to potential buyers. Here are the essential steps to stage your home for Winter to create a warm, welcoming atmosphere for prospective buyers.

1. Curb Appeal with a Seasonal Twist

Don’t underestimate the power of curb appeal. While fall and winter may not have the vibrant blossoms of spring, you can enhance your property’s exterior by:

- Adding seasonal plants: Add potted mums, ornamental cabbages, and winter-friendly greenery to your porch.

- Updated Entryway: Replace your doormat with a fresh, seasonal one and spruce up your front door with a coat of paint or updated hardware.

- Outdoor lighting: With shorter days, ensure that outdoor lighting is both functional and visually appealing.

- Porch Décor: Incorporate tasteful seasonal touches, like a seating area (if space allows), wreaths, or garlands.

2. Embrace Cozy Textures and Warmth

Create an inviting atmosphere that buyers will want to linger in:

- Layered textiles: Use plush throws, pillows, and area rugs in warm colours like deep reds, oranges, and browns to add texture and comfort to your living spaces.

- Fireplace focus: If you have a fireplace, stage it with cozy seating and light it during showings to create a centerpiece of warmth.

- Maintain Optimal Temperature: Set your home’s temperature to a cozy 70-73°F to ensure buyers feel comfortable during showings.

3. Seasonal Decor Done Right

A touch of winter charm can help your home stand out without overwhelming buyers:

- Wreaths and Garlands: Use tasteful, neutral wreaths and garlands to decorate doors and mantels.

- Centerpiece’s: Display a bowl of seasonal fruits, unscented candles, or pinecones for an elegant touch.

- Subtle Décor: Keep holiday decorations simple and neutral to appeal to a wide range of buyers.

4. Optimize Lighting

With shorter days, brightening your home’s interior is essential:

- Ambient lighting: Add floor and table lamps with warm-toned bulbs to enhance the cozy atmosphere.

- Mirrors: Place mirrors strategically to reflect natural light and make rooms appear more spacious.

- Tasteful Holiday lighting: Use string lights or lanterns outdoors to create a magical winter vibe.

5. Maintain Cleanliness and Safety

Snow and ice can pose challenges, but proper maintenance ensures your home feels welcoming:

- Clear Walkways: Keep all driveways and walkways free of snow and ice for safety and a neat appearance.

- Clean Windows: Maximize winter sunlight by keeping windows spotless.

- Tidy Floors: Regularly vacuum to remove snow or salt tracked in from outside.

Key Points

- Boost curb appeal with updated entryways, seasonal plants, and solar lighting.

- Incorporate warm textures like throws and area rugs for a cozy ambiance.

- Use subtle, tasteful seasonal decorations to enhance charm without overwhelming buyers.

- Focus on lighting to create a bright and inviting interior.

Selling your home during the colder months can be highly rewarding with the right staging. At The Royle Group, we are committed to helping you prepare your property for success, no matter the season.

Contact us today for personalized guidance and expert insights. Together, we’ll make your real estate journey a success this winter!

Want more like? “Stage Your Home for Winter”

Learn More:

- Why Houses Don’t Sell

- Increase Your Home Value With Curb Appeal!

- Home Selling Resources, Podcast Episodes & More

Tools & Resources:

- Prepare To Sell: Download Our FREE Listing Guide

- Curious What You Can Afford?: Use Our Buyers Calculator

- Searching For Options?: Start Your Property Search

- Hoping to Sell? Get A Free Home Valuation

- Book A Consultation With One of Our Agents

![Benefits of Mortgage Pre-Approval Checklist: [Check Mark] Understand Your Budget [Check Mark] Focus Your Search on Properties Within Your Price Range [Check Mark] Save Time and Energy [Check Mark] Confidently Make Offers [Check Mark] Streamline the Closing Process THEROYLEGROUP.CA](https://theroylegroup.ca/wp-content/uploads/2024/01/LeadPagephoto-33.png)

![Documents Required for Pre-Approval Checklist: [Check Mark] Proof of Income [Check Mark] Bank Statements [Check Mark] Employment Verification [Check Mark] Identification [Check Mark] Credit Report [Check Mark] Other Financial Documentation THEROYLEGROUP.CA](https://theroylegroup.ca/wp-content/uploads/2024/01/LeadPagephoto-34.png)

![Mortgage Pre-Approval Common Misconceptions Checklist: [Check Mark] Pre-Approval Guarantees a Loan [Check Mark] Pre-Approval is Only Valid for a Limited Time [Check Mark] Pre-Approval Affects Credit Score [Check Mark] Pre-Approval is a Commitment to a Specific Lender THEROYLEGROUP.CA](https://theroylegroup.ca/wp-content/uploads/2024/01/LeadPagephoto-35.png)

![Steps to Take After Receiving Pre-Approval Checklist: [Check Mark] Start Your Home Search [Check Mark] Make Strong Offers [Check Mark] Submit Required Documents [Check Mark] Stay in Touch With Your Lender [Check Mark] Conduct a Home Inspection [Check Mark] Finalize Your Loan THEROYLEGROUP.CA](https://theroylegroup.ca/wp-content/uploads/2024/01/LeadPagephoto-36.png)